US President Donald Trump’s first week in office brought a flurry of activity, with executive orders and tech developments signaling a shift toward the pro-business environment promised to voters. Among other moves, the president set his plans to establish a ...

American Express’ affluent cardholders got comfortable spending more freely again late last year, Chief Financial Officer Christophe Le Caillec told CNBC. Spending on AmEx cards jumped 8% year over year in the fourth quarter after slowing from a 7% growth rate early in ...

Universal is hoping the excitement around “Wicked” can hang around — for good. The movie studio faces a unique challenge: promote and release two build-on films just one year apart. Part one of the “Wicked” cinematic project dazzled at the box ...

Remember that old commercial, “It’s not nice to fool Mother Nature?” Well, there should be another one pertaining to the stock market, “Don’t bet against a secular bull market advance!” We’re all trained, or brainwashed, if you will, to believe ...

Despite periodic rallies that have buoyed the home improvement retail sector, Lowe’s (LOW) is showing signs of potential weakness. Recent price action in Lowe’s stock and lagging growth metrics suggest that its latest attempt to sustain a breakout may run ...

The Biotech industry group is making a comeback, with the ‘under the hood’ chart displaying new strength coming into the group. We have a constructive bottom that price is breaking from and, while it does need to overcome resistance at ...

Mag7 ETF Leads as Bullish Pattern Forms – Charting the Trends and Trading Setups for the Mag7 Stocks

The Mag7 ETF (MAGS) formed another short-term bullish continuation pattern as it worked its way higher since the triangle breakout in mid September. This report will also analyze the long-term trends, highlight the short-term setups and compare performance for the ...

Gold mining stocks have been climbing since the end of December, a trend that usually goes unnoticed unless gold — often dismissed as an “old relic” — undergoes one of its periodic shifts into a timely and relevant asset. Recently, ...

Despite the strength in some key growth stocks in January, semiconductors have been decidedly rangebound for most of the last six months. While this week’s breakout of the range appears to be a significant bullish signal, the bearish candle pattern ...

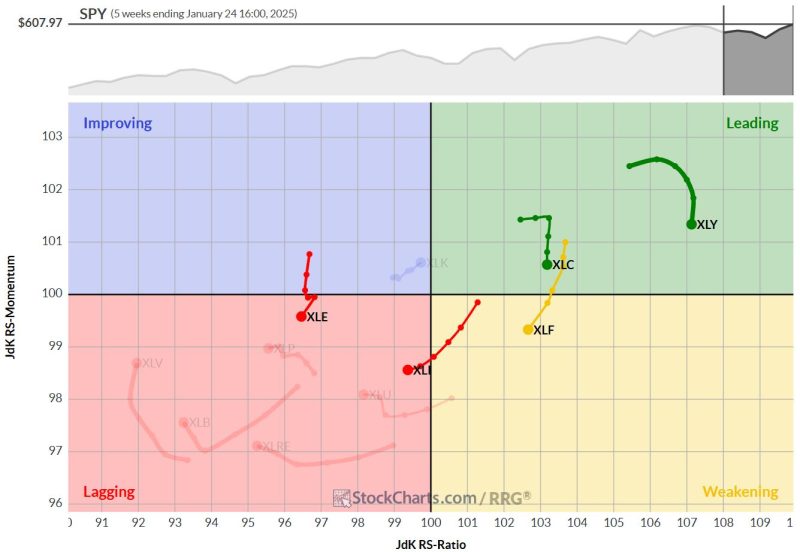

No changes in the top-5 At the end of this week, there were no changes in the ranking of the top-5 sectors. (1) XLY – Consumer Discretionary (2) XLF – Financials (3) XLC – Communication Services (4) XLI – Industrials ...