Israel’s military has raided and ordered the closure of Al Jazeera’s office in Ramallah, in the occupied West Bank, the network said. Al Jazeera broadcast live footage early on Sunday of Israeli soldiers entering its offices in Ramallah, capturing the ...

All eyes were on interest rates this week as the US Federal Reserve’s two day meeting took place. Meanwhile, Bitcoin and Ether rallied later in the week, but analysts are uncertain about the sustainability of their gains. Elsewhere, Apple’s (NASDAQ:AAPL) ...

Sierra Nevada Gold (ASX: SNX) is pleased to announce it has staked two additional projects prospective for high-grade silver-gold-copper near existing projects in Nevada, USA. The new projects are 10km west of SNX’s large-scale Blackhawk Porphyry and Epithermal Projects in ...

A major strike is on the horizon for thousands of maritime workers, posing a threat to East Coast ports responsible for billions of dollars of goods. The International Longshoremen’s Association (ILA), the largest union of maritime workers in North America, ...

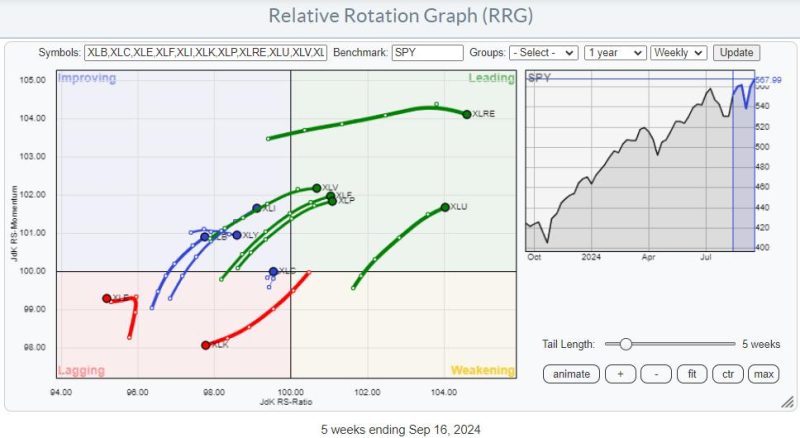

If you logged into the CNBC website on Thursday morning, you might have seen the headline, “Wells Fargo says don’t buy this rally, fundamentals don’t support it.“ Investors relying solely on fundamentals and not knowing how to read market technicals ...

Sentiment indicators are contrarian, meaning that when the majority of investors are bullish on the a market, it is bearish for that market. Most investors are aware of several sentiment indicators that relate to the stock market, but they may ...

First of all, I apologize for my absence this week. I caught something that looked like Covid, and felt like Covid, but it did not identify (pun intended) as Covid. Apart from feeling lousy, also my voice was gone, so ...

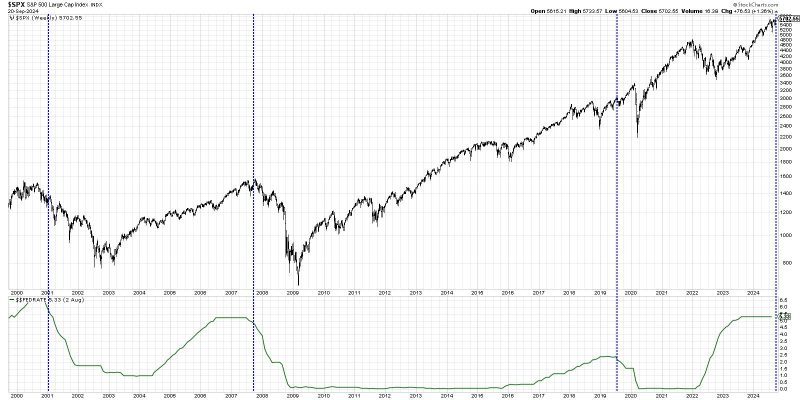

The Federal Reserve’s interest rate cut decision on Wednesday was like receiving a gift from a wish list. When the rate cut was announced, the market initially rose, acting surprised by the decision. But the excitement fizzled off as the ...

In this StockCharts TV video, Mary Ellen reviews the broader markets after last week’s rate-cut induced rally. She also shares stocks that are breaking out of bases and poised to trade higher. The “nuclear renaissance” is also discussed, as well as ...

So the first Fed rate cut is behind us, and we are no longer in a “higher for longer” period, but in a new rate cut cycle which will most likely last well into 2025. So that’s good news for stocks, ...